With all the press surrounding the debt crisis in government, pension and insurance funds are seeking alternatives to government bonds. Palmer Capital is joining forces with a top renewable energy group in what is to be the UK’s first ever fund involved in the acquisition of solar energy farms.

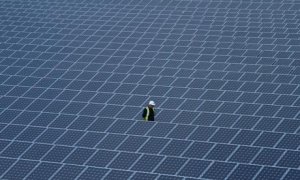

This new fund has a goal of raising £52 million which will be used for the purchase of 3 solar parks which together account for approximately 33% of solar output in the UK. The parks in question are owned and operated by Low Carbon.

This particular fund echoes the sentiments of international investors who are looking for alternatives in infrastructure as opposed to traditional government bonds. To date these funds have been targeting such investments as government schools, airport concessions, hospitals and even toll roads as they are seeking long-term income streams.

According to the CEO of Palmer Capital, institutional investors will now be able to place their investments into an asset category that is sustainable over the long term. Because of the growing need for alternative sources of energy, this is felt to be a perfect fund to meet long term goals. Energy statistics in the UK are indicative of just how successful these types of funds should be.

Data released by the Department for Energy and Climate Change indicates that the UK had a 10% surplus of energy in the year 2000 and is now dependent on imports for as much as 1/3 of its consumption annually. As well, fossil fuels account for 90% of the country’s energy supply with only 3.3% accounted for by renewable.

With an ever increasing need for renewable energy sources, it is forecast that more pension and insurance funds will echo Palmer Capital’s groundbreaking investment strategy. With each park generating enough electricity to power 3,000 homes for one year, this is seen as a potentially lucrative investment scheme. Profits realised will then be used to develop and maintain greater numbers of alternative energy sources, shaping an innovative low carbon economy.