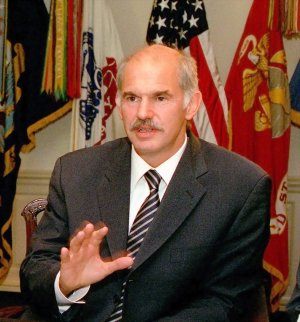

Although the news was released that Prime Minister George Papandreou has resigned his post in order to spearhead a new ‘unified’ Greek coalition government, there are still major details missing as to just how this new regime will operate. With such sketchy information, world markets are still in turmoil as to how this will impact the debt crisis in the eurozone.

Unfortunately, these details will not be made public until well after financial markets around the world are opened and up for trading. This is fuelling the fire that is growing under world leaders that a new global recession is impending and that this ‘new’ government in Greece may be in as much disarray as the current socialist ruling party.

Then, there are new fears rising because of Italy’s own debt crisis which is further jeopardizing the Euro as a single currency. With near bankrupt Greece and it’s Mediterranean neighbour Italy in so much peril, hopes are quickly waning for a speedy debt recovery as had been the hope when heading into the G20 summit in Cannes.

However, the largest concern at the moment seems to be that there is no clear indication as to who would be Papandreou’s successor. This is bracing the financial markets for a volatile day whilst awaiting details of the new government in Greece. Some world economists are predicting further losses whilst others feel that a change in Greece’s political scene will be viewed in a positive light by traders.

The goal of the new government is to secure the bailout package of last month for Greece and then to immediately hold new elections. Although the austerity programme imposed on Greece is a point of heated controversy, it is perhaps the only lever available to keep the debt-ridden nation from defaulting. Should this happen, there are well founded fears that the entire EU will be brought down with it.