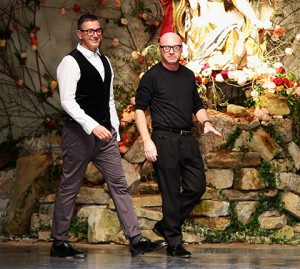

Two of Italy’s most well known fashion designers are facing a lengthy jail sentence for evading taxes on approximately £833 million in income. Stefano Gabbana and Domenico Dolce, the two founders of the famous Dolce & Gabbana fashion brand, were both sentences to twenty months in jail for their efforts to avoid paying tax.

Two of Italy’s most well known fashion designers are facing a lengthy jail sentence for evading taxes on approximately £833 million in income. Stefano Gabbana and Domenico Dolce, the two founders of the famous Dolce & Gabbana fashion brand, were both sentences to twenty months in jail for their efforts to avoid paying tax.

The two fashion designers reportedly used an external company in Luxembourg to avoid paying taxes on revenues earned by their Italian fashion brand. The brand is based in Italy but was reportedly sold to a Luxembourg-based company in 2004 for less than its real value in an attempt to hide revenue from Italian authorities.

The Luxembourg-based company was called Gado, an anagram formed by mixing the last names of the two designers. The company has been under investigation by Italian tax authorities for over six years as part of a nationwide crackdown on the use of international companies and tax havens for avoidance of Italian taxes.

Italy’s increased attention to tax evasion indicates that many European countries are struggling with complex tax plans and illegal arrangements. The UK recently made efforts to increase its ability to monitor overseas tax evaders – a move that many European countries are planning to copy to improve tax compliance.

Both designers denied the charges and claimed that their Luxembourg company was operating completely within the law. The two designers were previously acquitted of the charges during a case in 2011 that also accused them of fraud, but the Italian high court later decided that the tax evasion charges were justified and legitimate.

The Italian court’s decision is the latest case in a wave of tax-related prosecutions in Europe. Dolce and Gabbana are appealing the decision and aim to avoid the twenty month prison sentence, which many in Italy believe may be suspended.