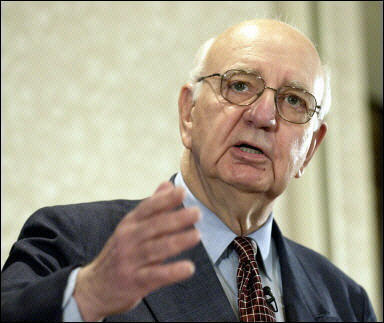

Some of the United States’ largest banks are struggling with a new compliance rule known as the Volcker rule. Named after the former chairman of the Federal Reserve, Paul Volcker, the rule is one of the new pieces of legislation that make up the Dodd-Frank financial reform bill, which was issued into law in 2010.

Some of the United States’ largest banks are struggling with a new compliance rule known as the Volcker rule. Named after the former chairman of the Federal Reserve, Paul Volcker, the rule is one of the new pieces of legislation that make up the Dodd-Frank financial reform bill, which was issued into law in 2010.

The new rule prevents banks from taking part in proprietary trading – trading that goes on from banks’ own accounts. It also restricts banks from taking part in some types of market making and hedging. The bill was passed by Barack Obama in 2010 in response to the irresponsible trading that created the recent financial crisis.

Banks, so far, are struggling to change their operations in order to comply with the new legislation. Compliance programmes are coming into place that address most of the bill’s requirements, but implementing such programmes over a large company is rarely a quick or painless process.

The Dodd-Frank bill is particularly taxing on banks, as chief executives are required to confirm in writing that new processes – the bill specifically requests “reasonably designed” programmes – have been put in place to ensure that the company can achieve compliance with the bill.

The Volcker rule was the product of more than four years of work. Since the rule has been approved, the 71-page measure and its 900-page supporting preamble took on a new significance for banks. Many have devoted significant resource into viewing how it could affect their core business practices.

Much of the concern is due to the bill’s overly vague and subjective wording. Many of the lawyers working on compliance programmes for major banks believe that the phrases used in the bill, such as “reasonably designed”, are highly subjective and far from the objective, firm language that banks can easily comply with.