With the cost of living crisis showing no sign of abating, despite the recent better economic news, we’re all focussing on how we can save money. Although the government have claimed that UK pay is rising in real terms, it’s yet to feel that way in our wallets, and more of us than ever are looking at our weekly outgoings to see where we can cut costs.

How to start saving

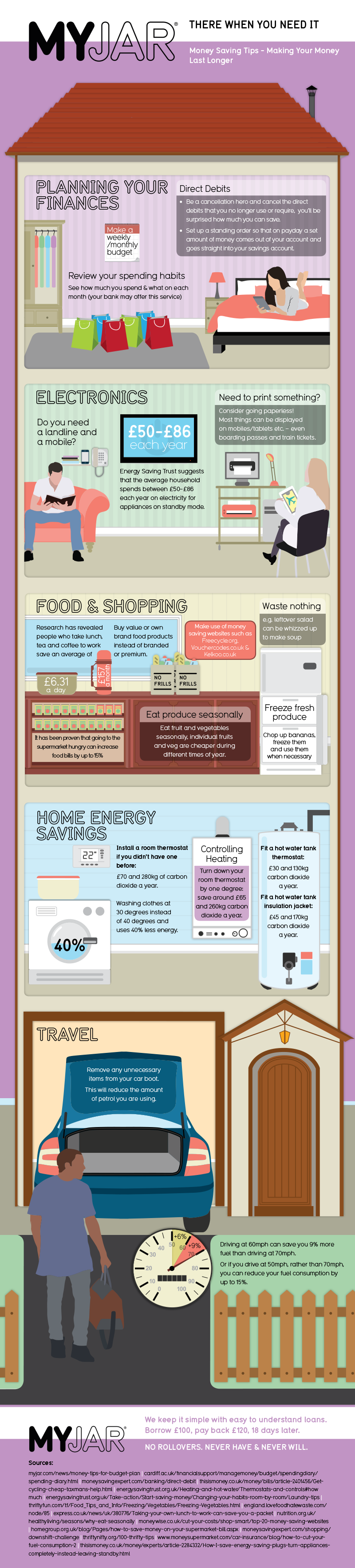

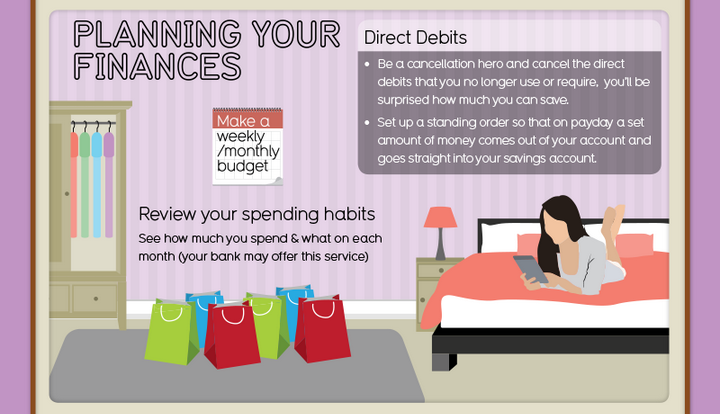

The infographic below shows how you can break down your day to day living costs to find areas where you can trim your expenses. While short term loans from responsible and transparent lenders such as MYJAR are useful alternatives to expensive credit cards in an emergency, getting a grip on your total spending is the only way to achieve financial stability.

Clear your debts

Your first priority should be to clear debts that are costing you huge amounts in interest. Credit cards are a useful way of paying for goods and services, but if you’re struggling to pay off the balance every month, the resulting interest payments will be killing any hope you have of escaping debt. Consider a small loan instead.

Use price comparison sites to cut costs

You can potentially cut the cost of many of your bills by using price comparison sites to find better deals than those you are currently on. Check if you can get better deals on your fuel bills, insurance, mobile phone and home broadband.

Food shopping tips

Save money on food shopping by purchasing own-brand products, trying markets for cheaper fruit and veg, and using store discount cards and vouchers. Make sure you write a shopping list before you head to the supermarket and then stick to it while you’re there, avoiding the tempting delights of things you don’t need.

There are a few basic tips to get you started, but check out the infographic below for lots of great money saving tips.