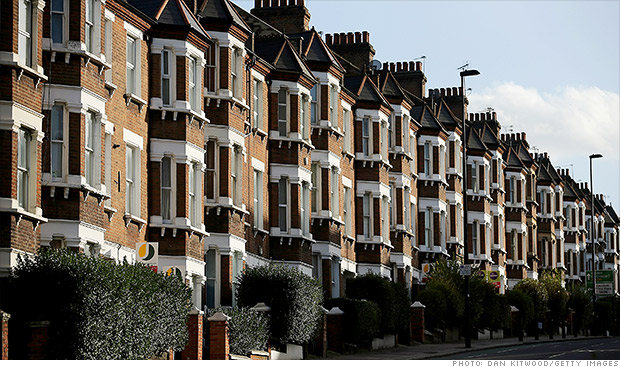

A report from Paris-based think tank, the Organisation for Economic Co-operation and Development, warns that the government and Bank of England might need to take steps to reduce he scale of mortgage lending to prevent a real estate bubble from hurting long-term UK economic growth.

A report from Paris-based think tank, the Organisation for Economic Co-operation and Development, warns that the government and Bank of England might need to take steps to reduce he scale of mortgage lending to prevent a real estate bubble from hurting long-term UK economic growth.

According to the think tank, a failure to stop increasing house prices could result in prices “spiralling out of control” and affecting the economy. The organisation notes that government schemes such as the Help to Buy scheme are fuelling a real estate bubble that will eventually cause the market to overheat.

Other issues include the low deposits many borrowers are required to put down for mortgages. The organisation recommends introducing new regulations requiring a larger deposit as a percentage of total home loans in order to reduce the demand for housing in the UK.

The latest OECD report forecasts annual growth of 3.2 per cent for Britain during the rest of 2014 – a significant increase from its 2.4 per cent growth estimate from November of last year. The figure puts the UK’s economic growth ahead of the USA, France, and Germany, which is expected to grow by 1.8 per cent in 2014.

The organisation also upgraded Britain’s 2015 economic growth prospects to 2.7 per cent, noting that “accommodative monetary policy” has supported the British economic recovery, along with strong employment growth. The latest economic outlook report also indicated a pick-up in investment throughout the UK.

At the same time, the report warns that there could be long-term side effects from the rapid increase in housing prices fuelled by programmes such as Help to Buy. If the government doesn’t take steps to reduce demand for housing, the OECD thinks that a dangerous housing price bubble could grow alongside the UK economy.