When you come to transfer money abroad for any purpose through your bank or through a foreign exchange provider, you often come across hidden fees. While banks and FX providers alike take pride in the fact there are no commission, in fact there is a “commission-like” component to the pricing that most people are not aware of. That component is the cost of currency. If you are offered a currency at a certain rate, you should know that whoever offers it back to you – whether it’s a bank, FX provider, exchange bureau or your hotel – is buying it for less. How much less? Usually, a lot less.

Banks have access to currencies through sophisticated trading platforms in which they trade currencies with other major players (banks and central banks). The average between the Buy-price listed on such trading platforms is called the interbank rate which is the official rate which is also cited by bank banks on their website – for example the BoE list of foreign exchange rates.

The difference between what banks pay and the rate in which they sell currencies to clients is called a markup, and it could be huge – a much larger fee than the fixed fee banks would charge for an overseas transfer. For instance NatWest charges around 4% in these hidden fees!

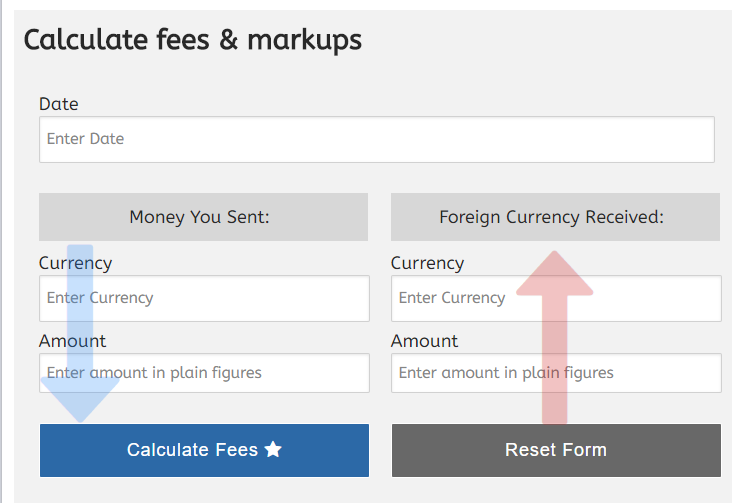

So what do you do? MoneyTransferComparison have developed a money transfer fee calculator that works for a current quote or for a past quote and can break down the REAL cost you, and allow you to make a more concise choice about choosing the best money transfer provider for your needs. Play around with it and let us know your thoughts!