Technical analysis attempts to explain the Forex market movements by using psychology and known market patterns. Since it is not based on anything “substantial” — like maths — a lot of traders ignore or mistrust this technique.

However, it does produce viable results. With this article, we are going to explain:

- What is technical analysis and how it works;

- How to trade using technical analysis.

Technical Analysis — How to Read Market Patterns

The basic idea behind technical analysis is that nothing happens in a vacuum. Each massive price movement is telegraphed way in advance — as long as you know where to look. And if you are thinking “hey, that’s pretty much Price Action”, you are absolutely right. Technical analysis acts as the theoretical foundation for this long-term trading strategy.

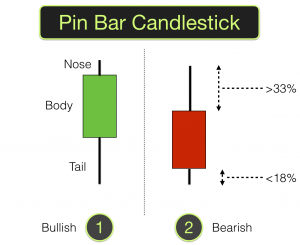

The best explanation of technical analysis in action is Pin Bar. It’s a relatively common market pattern, that is clear and easy to trade.

Pin Bar indicates the reversal of the trend. The trend initially moves in one direction, which gives the Pin Bar a long tail, but then turns around and closes in a different direction. This new direction is now dominant, and you can safely place orders on it.

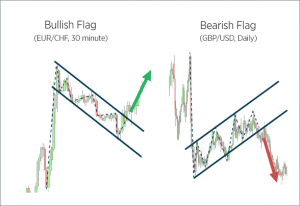

Other patterns describe market intentions before they even become a reality. For example, Flag patterns tend to break out in the opposite direction to their initial movement. Triangles, on the other hand, break out in the same direction.

Technical analysis works on any timeframe, but the longer ones are much better for it. On H4 or even 1D you have more time to analyze the situation and make correct decisions.

How to Trade Using Technical Analysis

Trading using technical analysis is also called Price Action. It’s a somewhat involved trading strategy that lists the common Forex patterns and explains the most profitable ways of trading on them.

However, if you want to keep it simple, here’s an example of trading on an H4 timeframe:

| Pattern | Date | Trading Strategy |

| Pin Bar | December 18, 20:00 |

Entry at 1.13750 TakeProfit at 1.14035 |

| Pin Bar | December 19, 12:00 |

Entry at

1.13925 Entry price isn’t reached |

| Inside Bar | December 20, 00:00 |

Entry at

1.13765 TakeProfit at 1.14035 |

As you can see, not all patterns pay off — the trend can reverse before it reaches the entry price. Sometimes it even happens after the entry price is reached, which is why you should use StopLoss mechanisms.

If you want to trade using technical analysis, you need to learn the basic patterns. We recommend to start with:

- Pin Bar

- Inside Bar

- Outside Bar

- Fake Breakout

- Double High/Double Low

Once you understand the basic Price Action patterns, you are going to need a Forex broker. We recommend Forex broker JustForex — despite being a smaller operation, this company cares about its customers. Their support is reliable, the order processing is robust, and they provide a lot of leverage options that will help you increase your Price Action profits.