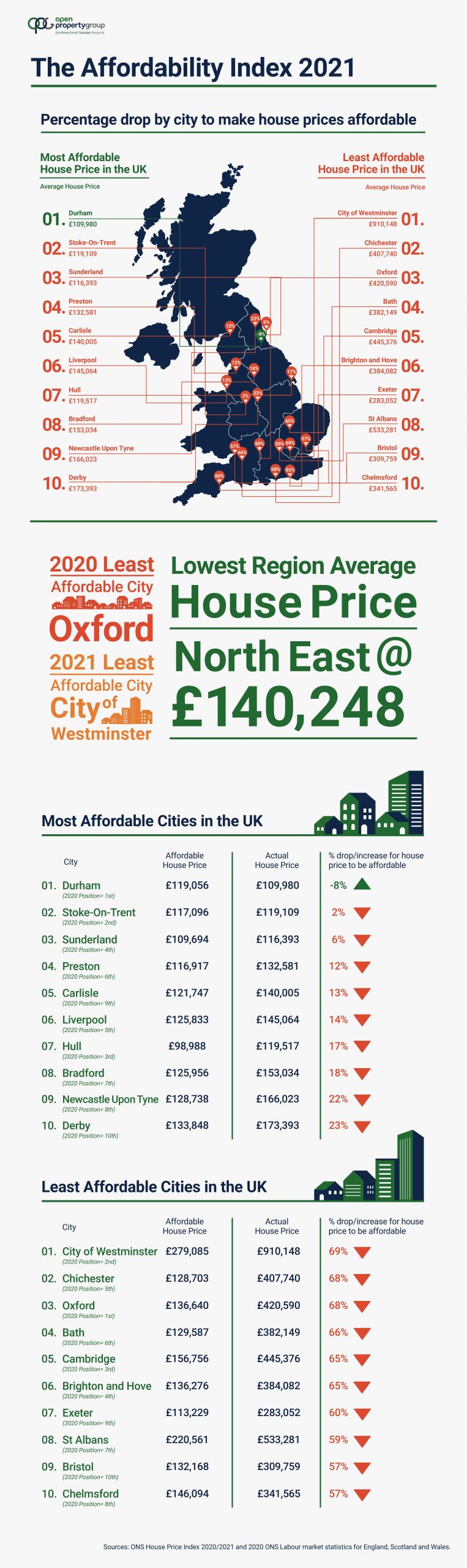

In 2021, property prices in cities across the UK need to fall by an average of 37% to make owning a home affordable for a single person earning an average wage according to research from Open Property Group.

At one end of the country, the gap between ‘average salary’ and ‘average house price’ has grown over the last 12 months. In 2020, Oxford held the title of the ‘Least Affordable City’. In 2021, however, City of Westminster was crowned the ‘Least Affordable City’ to buy a house in, with houses prices needing to drop by 69% to become affordable.

The North-South divide continues to be evident, as the 2nd and 3rd most overpriced cities in the UK were Chichester and Oxford where house prices would need to see a 68% decrease to be affordable to buy.

Using average salary and house price data for cities, it can reveal that Durham is the only place that is affordable for a single person with an average salary for that city and a mortgage of 3.5 times salary.

House prices in Durham could rise by 8% and still be affordable for someone on an average wage with a 20 per cent deposit.

Open Property Group Managing Director, Jason Harris-Cohen said: “Our research also shows that the Stamp duty holiday increased property prices and demand, The number of mortgage approvals for house purchases in the UK increased to 105,000 in November 2020, the highest level since August 2007 and well above market expectations of 82,500.”