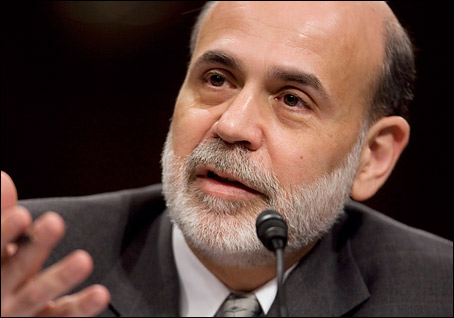

The United States’ economic policy of quantitative easing will come to an end during 2014, Federal Reserve chairman Ben Bernanke claimed. The Federal Reserve’s third quantitative easing effort, named QE3 by American analysts, is still underway, with the fiscal policy unit expanding the country’s money supply to stimulate growth.

The United States’ economic policy of quantitative easing will come to an end during 2014, Federal Reserve chairman Ben Bernanke claimed. The Federal Reserve’s third quantitative easing effort, named QE3 by American analysts, is still underway, with the fiscal policy unit expanding the country’s money supply to stimulate growth.

Quantitative easing has been one of the United States government’s controversial economic policies implemented to ease the effects of the housing market crash and growing financial stagnation. The policy has involved the government buying large amounts of assets in an effort to improve the country’s economic performance.

With growth rates slowly increasing and unemployment figures indicating a return to the workplace for many formerly out-of-work Americans, the Fed hopes to end its current QE3 program by mid-2014. The announcement that quantitative easing will end in the next year caused several US financial markets to decrease in value.

The Federal Reserve still plans to spend $85 billion per month on asset purchases, as the quantitative easing policy is seen as vital to economic growth. However, the policies will slowly ease during 2014 as unemployment rates decrease and major economic growth brings greater stability to the United States’ job market.

Quantitative easing has been a controversial policy for the Federal Reserve, with a large number of formerly supportive economists growing opposed to the policy as its expansion of the money supply produced side effects. One of the major effects of quantitative easing is an artificially interest rates, which are a reality in the USA.

Bernanke claimed that the Fed will ease its low interest rates as the unemployment rate shows signs of steadying at around 6.5 percent. Federal Reserve spokespeople also noted that the Fed could lower its threshold for increasing interest rates if the economy showed an exceptional rate of recovery.